ad valorem tax florida exemption

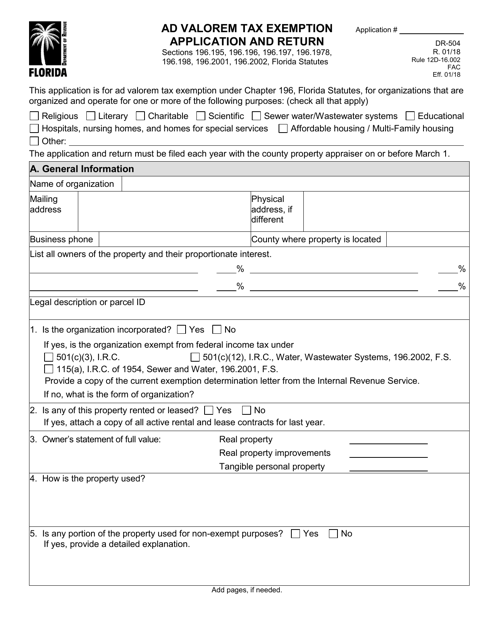

This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are. The exemption may remain in effect.

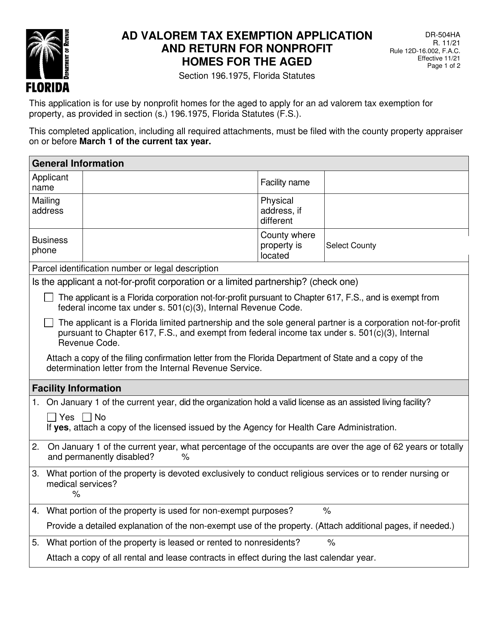

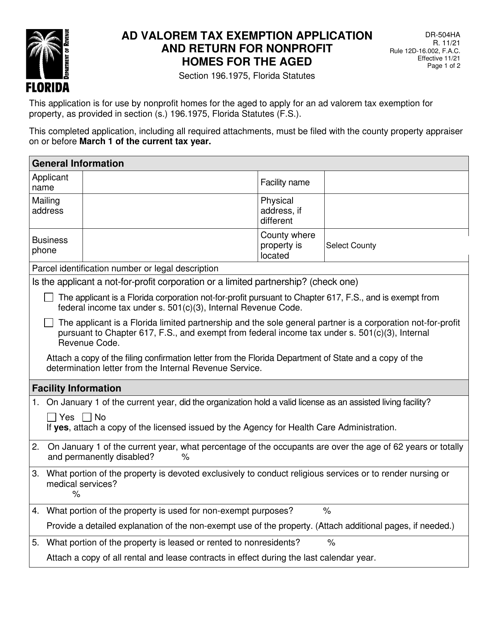

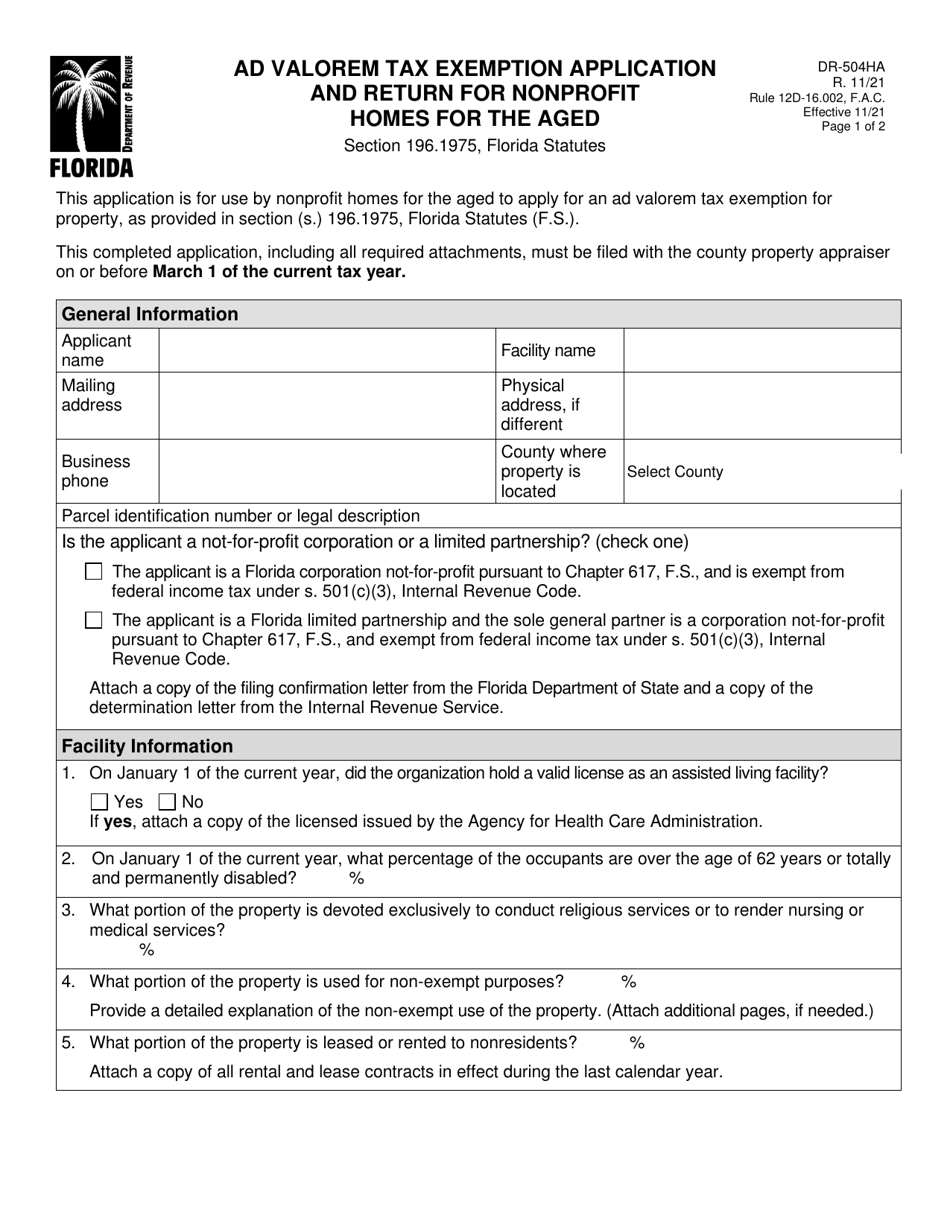

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

A yes vote supports continuing the levying of an ad valorem tax at a rate of 1 per 1000 of assessed property value for four years 2023-2027 to pay school teachers and fund school programs.

. The Orange County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Orange County Public Schools on August 23 2022. HOMES FOR THE AGED. This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances allowing a property tax exemption for up to 100 of the increase in assessed improvements resulting from an approved rehabilitation of a qualified historic property.

Taxes usually increase along with the assessments subject to certain exemptions. An ad valorem tax is based on the assessed value of an item such as real estate or personal property. If a Florida Property Tax Appraiser denies your longstanding ad valorem tax exemption you may be able to get it back by challenging the denial in front of.

Ad Valorem Tax Exemption Application and Return Religious. Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty.

Ad Valorem Tax. 1299 section 1961995 FS PDF 446 KB DR-418C. The greater the value the higher the assessment.

Property Tax Exemption for Historic Properties. 2 a 3 cap on the annual increase in the ad valorem tax value of the home. 3 portability of an under-assessment the amount by which.

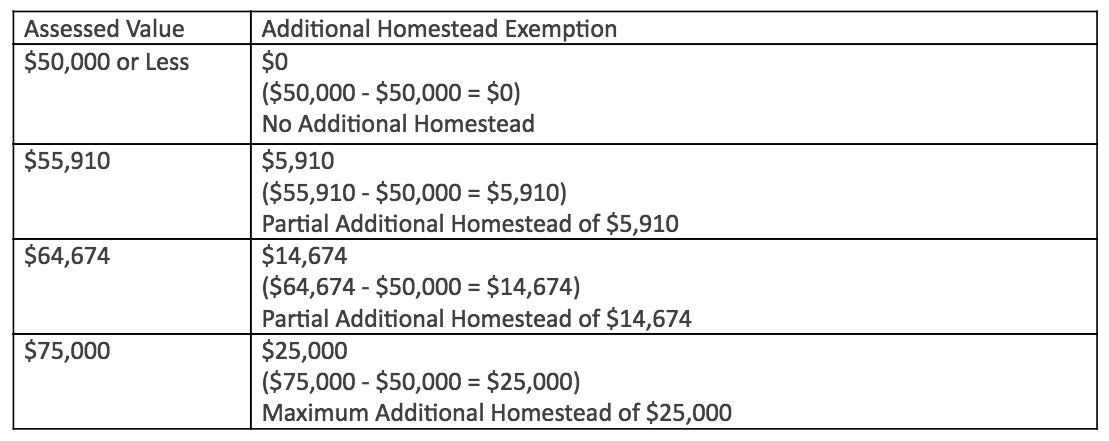

The most common ad valorem taxes are property taxes levied on real estate. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR MULTIFAMILY PROJECT AND. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes.

1961995 FS grant an economic ad valorem tax exemption for an expansion. The exemption applies only to improvements to. 196182 Exemption of renewable energy source devices.

Economic Development Ad Valorem Tax Exemption. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS. The program enables Pinellas County to more effectively stimulate job creation.

PDF 125 KB Individual and Family Exemptions Taxpayer Guides. In Florida property taxes and real estate taxes are also known as ad valorem taxes. PdfFiller allows users to edit sign fill and share all type of documents online.

Did you possess a valid license under Chapters 395 400 or part I of Chapter 429 Florida Statutes on January 1 of this year. Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. Have you qualified under Section 501c3 United States Internal Revenue Code 1954.

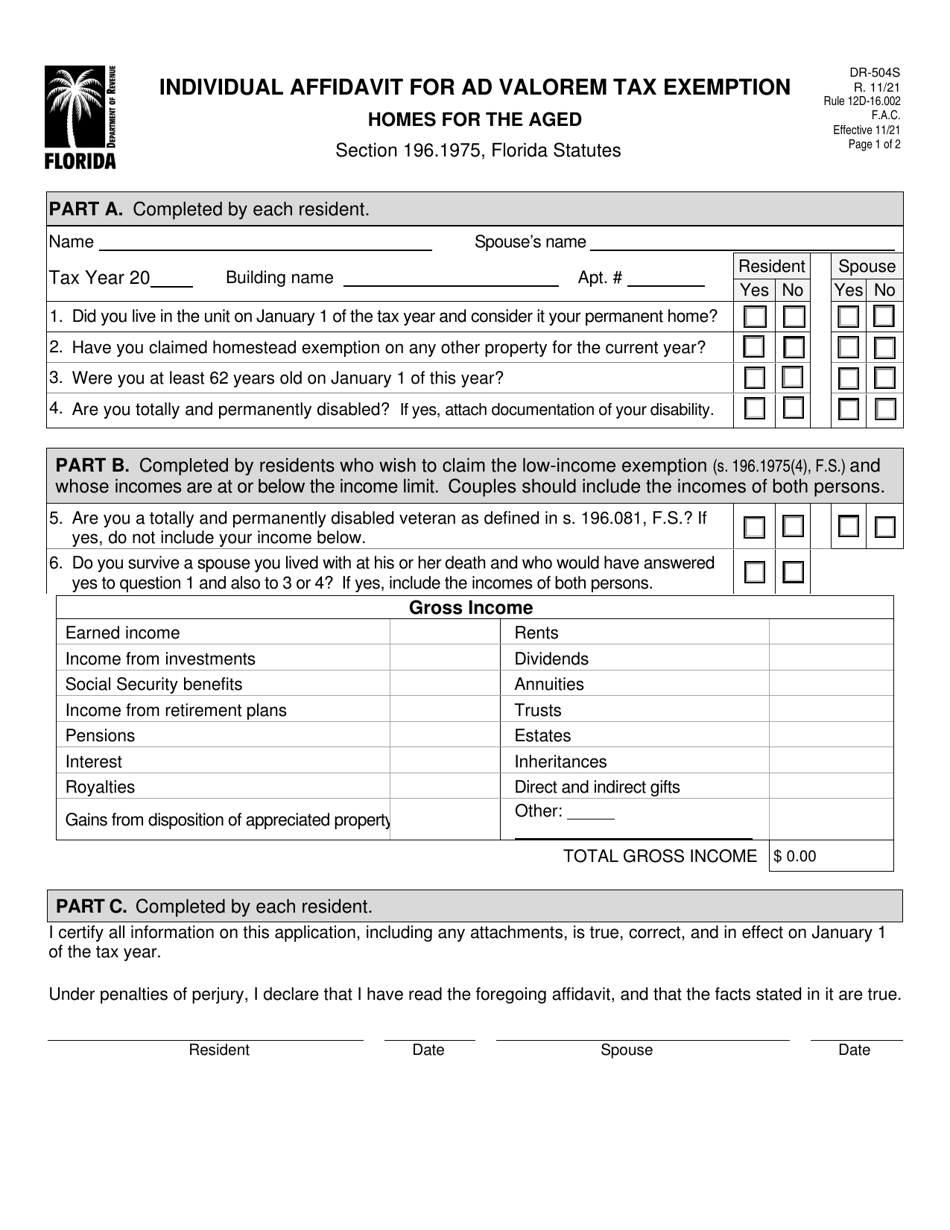

TAXATION--Economic development ad valorem tax exemption. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. 1 Eighty percent of the assessed value of a renewable energy source device as defined in s.

The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average salaries to locate here. Completed by each resident. 193624 that is considered tangible personal property is exempt from ad valorem taxation if the renewable energy source device.

Subscribe to Our Newsletter Subscribe Location. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in connection with. What is ad valorem tax exemption Florida.

Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

May a board of county commissioners pursuant to s. This completed application including all required attachments must be filedwith the county property appraiser on or before March 1 of the current tax year. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Hospitals Nursing Homes and Homes for Special Services. 1170 Martin Luther King Jr Blvd. 3 a State Const and s.

Section 1961978 Florida Statutes. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Economic Development Ad Valorem Property Tax Exemption R.

Fort Walton Beach FL 32547-5068. This is in response to your request for an Attorney Generals Opinion on substantially the following questions. Bldg 7 Suite 717.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. 2 The board of county commissioners or the governing authority of the municipality by ordinance may authorize the exemption from ad valorem taxation of up to 100 percent of the assessed value of all improvements to historic properties which result from the restoration renovation or rehabilitation of such properties. 1 The Board of County Commissioners or.

PO Box 4097. Section 1961995 Florida Statutes requires that a referendum be held if. A Is installed on real property on or after January 1 2018.

Name Spouses name. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. And Other Organizations chapter 196 FS.

Ad valorem means based on value. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in. Furthermore the court upheld the exemption because the discontinuance of the services provided by the Chamber of Commerce could result in the allocation of public funds for those services.

Municipal ad valorem tax exemptions are available only for property owned and used by a municipality for municipal or public purposes pursuant to Art. Section 1961975 Florida Statutes. Property owned by a church and leased to a municipality for use by the municipality as a municipal parking lot for which parking fees.

This application is for use by owners of affordable housing for persons or families with certain income limits as provided in section s 1961978 Florida Statutes FS to apply for a select one. What is ad valorem tax exemption Florida. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now.

Florida Administrative Code. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements. Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified as charitable under Section 501c3 of the Internal Revenue Code and in compliance with other requirements the nonprofit exemption under Florida Statutes Section.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Property Tax Homestead Exemptions Itep

What Is A Homestead Exemption And How Does It Work Lendingtree

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

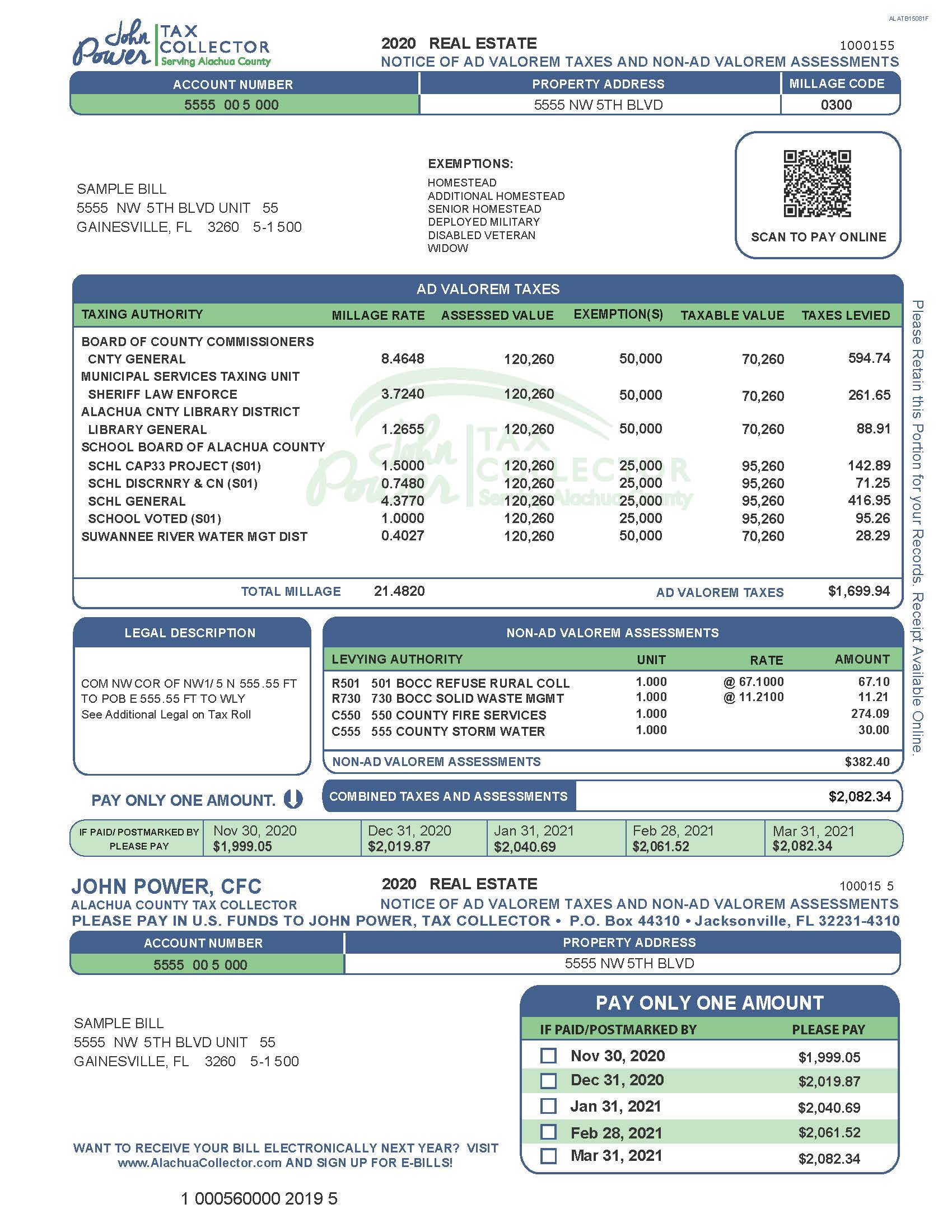

Explaining The Tax Bill For Copb

Homestead Exemption Attorney Miami Martindale Com

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

A Guide To Your Property Tax Bill Alachua County Tax Collector

Florida Homestead Exemption Chrisluis Com

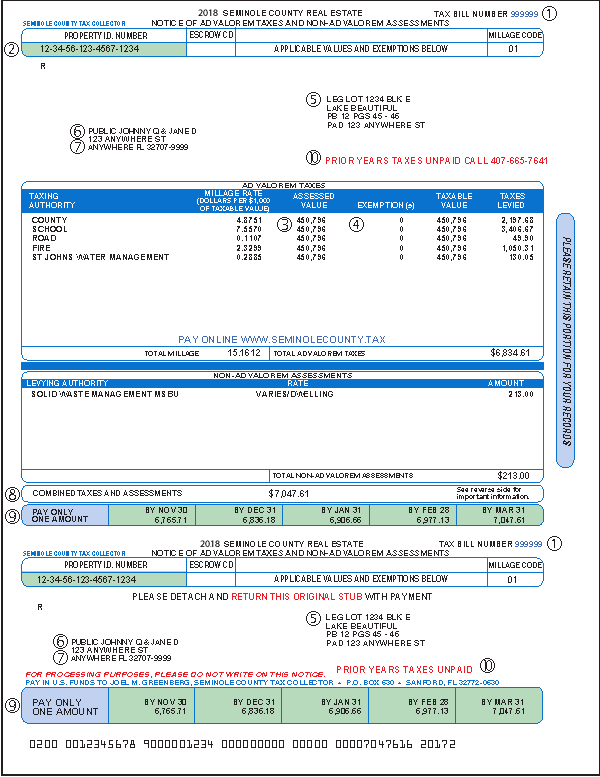

Understanding Your Tax Bill Seminole County Tax Collector

Exemptions Hardee County Property Appraiser

Real Estate Property Tax Constitutional Tax Collector

Form Dr 504s Download Fillable Pdf Or Fill Online Individual Affidavit For Ad Valorem Tax Exemption Homes For The Aged Florida Templateroller